RBI Proposal: The Reserve Bank of India (RBI) has suggested raising the cap on bank loans for initial public offerings (IPOs) and shares. Given that it will give them more money for capital market investments, this action may be a huge comfort to investors.

New Share and IPO Limitations

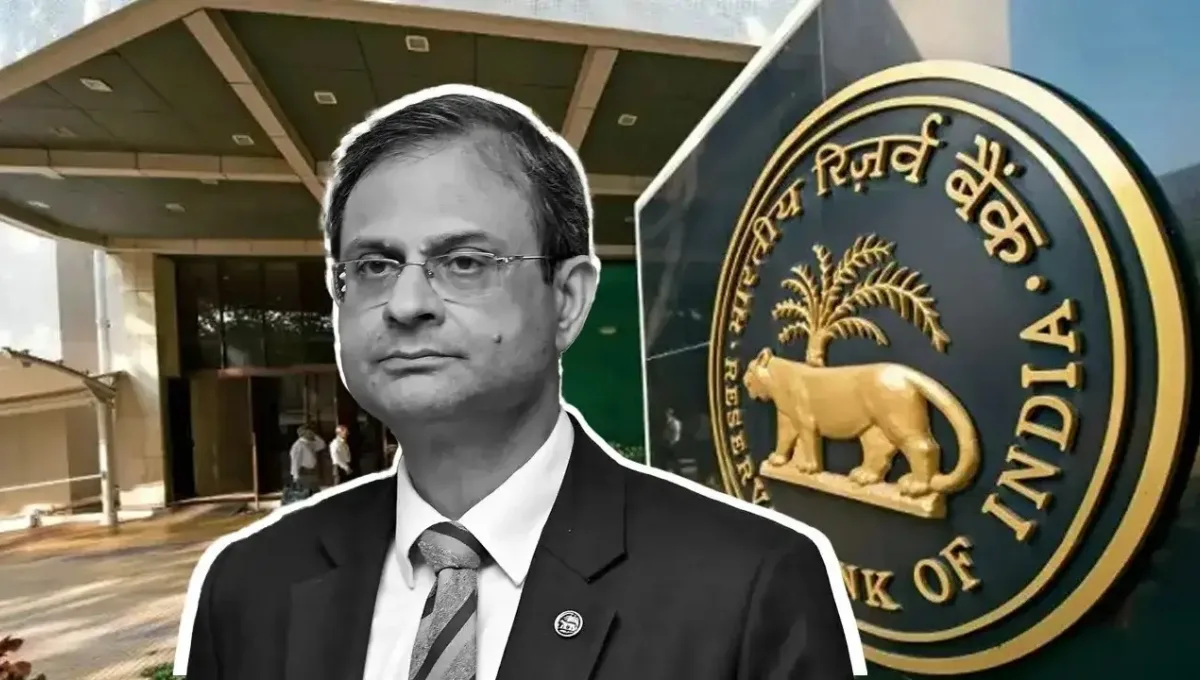

During the bi-monthly monetary policy announcement, RBI Governor Sanjay Malhotra said that it has been proposed to raise the present ₹20 lakh lending limit for banks to ₹1 crore. It has been suggested that the ₹10 lakh per capita loan maximum for IPO investments be raised to ₹25 lakh. Investors will receive more capital as a result, and stock market involvement will rise.

Effect on Investors

This move will also benefit small and medium-sized investors because it will allow them to make larger investments. The banking system’s increased lending will boost capital market liquidity and maybe open up new investment opportunities.

Emphasis on Infrastructure and Real Estate Investment Trusts

Additionally, the RBI has suggested raising the lending restrictions for Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs). It has also proposed lifting the existing regulatory restrictions on loan securities offered by banks. Capital investment in the infrastructure and real estate industries may increase as a result of these modifications.

Making the Capital Markets Stronger

According to experts, this idea will give the stock markets power and stability. Financing for acquisitions and new projects will increase if investors have easier access to credit. In the long run, this action might also help the Indian economy expand.

The RBI’s suggestion is regarded as a significant step in fortifying the banking system and capital markets. If put into practice, IPOs and equity investors will gain a great deal, and it may even spark a new round of economic investment.

Disclaimer: The sole objective of this article is to provide general information. Proposals, regulations, and loan limitations are subject to change. Please check the Reserve Bank of India’s official website or get in touch with the bank for accurate and current information.